Real Estate

Our past. Your future.

We have over a decade of experience in administering a variety of UK residential and commercial real estate owning Jersey structures.

We have supported the acquisition of stable assets and have regularly worked with development managers from inception right through the investment lifecycle.

We are practiced with the different structuring options available, from companies to partnerships to trusts, including in Jersey’s private fund regime.

These are some examples of developments we have been involved in:

Madison

£350,000,000 GDV

53-storey landmark residential tower with over 400 units located next to Canary Wharf.

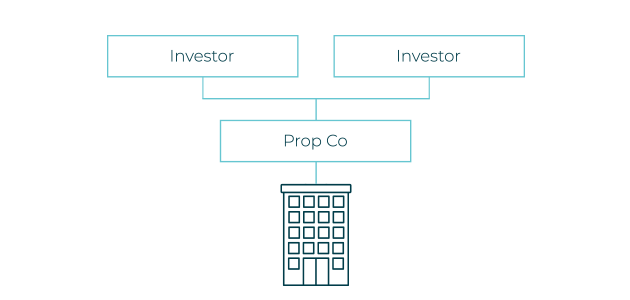

Joint venture between two investors, one Jersey and one Hong Kong based, with external debt facility.

Single Jersey company.

Oakbridge has been involved since inception.

HKR Hoxton

£65,000,000 GDV

A former bingo hall on Hackney Road, HKR was redeveloped by award-winning architects to offer 69 high-end residential units.

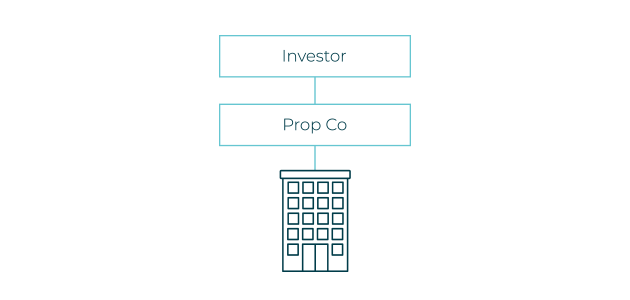

Single investor with external debt facility.

Single Jersey company.

Oakbridge has been involved since inception.

Grand Central Apartments

£73,000,000 GDV

Just West of St Pancras Station, residential tower offering 68 one, two and three bedroom apartments and penthouses.

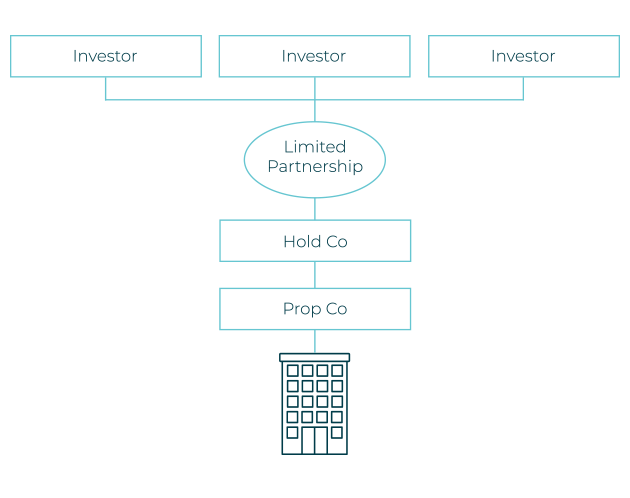

Structured for multiple investors, with external debt facility.

Jersey Partnership with multiple underlying Jersey companies.

Oakbridge has been involved since inception.

Our involvement spans the full lifecycle of the investment including:

- Engaging with legal and tax advisors to determine appropriate structure

- Liaising with client and advisors to finalise and adopt core commercial documents

- Preparing ancillary corporate documents

- Establishing the structure and opening bank accounts

- Liaising with the client and advisors to complete asset acquisition and external financing

- Liaising with the client to appointing the project team

- Providing ongoing and regular access to client entity directors

- Liaising with the client to complete sales and leases

- Liaising with the client and advisors to complete repayment of equity and debt funding

- Financial reporting throughout

- Deregistration and liquidation